OUR HISTORY

Generations of Investing, Supporting, and Growing Businesses

Now in its third generation of savvy investors, Dobbs Equity Partners has learned from its past to benefit your company’s future.

In 1921, James K. Dobbs took out a $25,000 loan and opened his first Ford auto dealership, alongside business partner Horace Hull. After just three years, the dealership was grossing over $1.25 million, and within ten years, Dobbs sold that dealership for ten times the loan value.

Thus, began the Dobbs family’s three generations of successful investment in private companies.

During the Great Depression, James and Horace invested in a chain of Jack Sprat Corp. hamburger stands. Disagreeing with company directors’ decision to put managers on a straight salary as opposed to an incentive-based pay, the partners instead started a business of cottage-type restaurants named Hull-Dobbs Houses to compete against Jack Sprat. After Dobbs successfully built the brand up to 50 Hull-Dobbs Houses, he ultimately sold the venture to Jack Sprat.

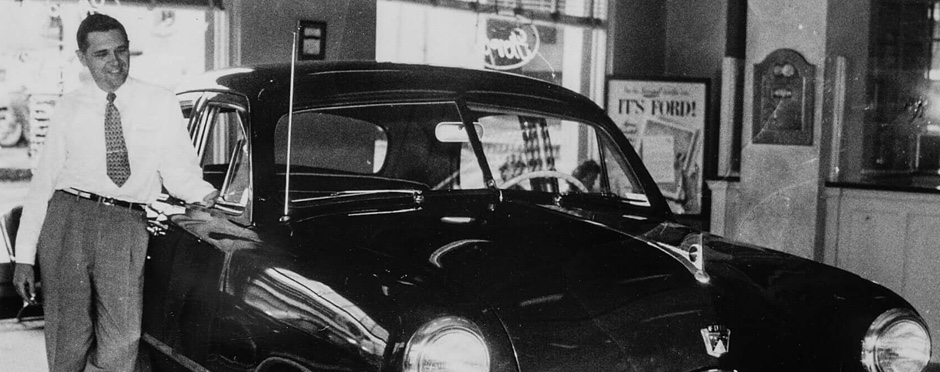

Salesman poses with latest Ford model on display in a Dobbs-Hull dealership.

Opening their first Ford dealership together with a loan for $25,000. James K. Dobbs and Horace Hull quickly became the first national dealership chain with over 60 locations.

In 1941, James Dobbs offered to help serve meals on a business flight after he learned that the stewardess for the flight was out sick. Realizing the potential for airline food service from this experience, Dobbs began Dobbs Houses Inc. By 1962, it had become the largest independent airline catering service in the world.

In 1942, as the country reacted to the attack on Pearl Harbor, the government quickly began freezing new car inventories and converting factories for the war effort. With a loan for $6.5 million, Hull-Dobbs Enterprises bought over 3,000 new and used cars and stored them. After the war, they were one of only a few companies that had cars to sell returning GIs.

In 1951, Dobbs Fleet Leasing was created as a supplement to the family’s primary dealership business. Providing nationwide fleet management to companies with fleets up to 500 vehicles, Dobbs Fleet Leasing further established Dobbs as a committed partner to business customers and original manufacturers.

In 1971, when Hull-Dobbs wanted to expand their dealership businesses, they took a chance on the relatively unknown Japanese car brands of Toyota and Honda. In the midst of the oil crisis of the mid-seventies, the company was in the perfect position to capitalize on the country’s new demand for these smaller, fuel-efficient Japanese imports.

In 1982, the Dobbs family purchased an Anheuser-Busch beer distributorship of six New Mexico cities, Premier Distributing Corporation, that it still owns today. Focusing on a long term strategic partnership with Anheuser-Busch, the family has grown market share in the area more than 30% over the course of its 30 year ownership.

In 1995, as a recession found financially struggling states looking for outside contractors to keep health insurance costs down, the Dobbs team invested in the Medicaid health maintenance organization Unison Health Plans (at that time called Three Rivers). In just over a decade, this HMO would be responsible for helping to insure nearly 350,000 people in five states. With profits over $1 billion, Dobbs sold Unison to United Health Group in 2008 in an all-cash deal.

By 1998, the Dobbs family had been in the automotive retail business for more than 80 years and the Dobbs Automotive Group was the third-largest retailer in the nation. As the HMO business took off, the family ended its tenure as an auto retailer and the Dobbs Automotive Group sold its 22 dealerships to AutoNation for $200 million in stock.

For more than 80 years, the Dobbs have sought out and created investment opportunities where many others would have seen only roadblocks. The Dobbs family has successfully invested alongside partners in multiple industries, including restaurants, airline catering, distribution, and health care.

John Hull Dobbs, Jr. has been an in integral part in growing the family business and continues the Dobbs family’s legacy of successful private equity investing with Dobbs Equity Partners, LLC.